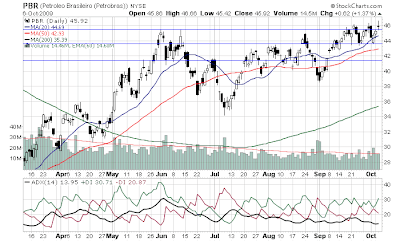

Without the market declining, oil should not break down further. About a week and a half ago, the oil charts (along w/the supply picture) seemed as it oil may test the low 60s/high 50s. However, the set up is different today. Especially when we factor in the commodity push via the Australian rate hike, and the continued weakness of the dollar. With this fundamental back drop, the chart set up looks very interesting. Interesting enough to so that the 75 resistance is challenged.

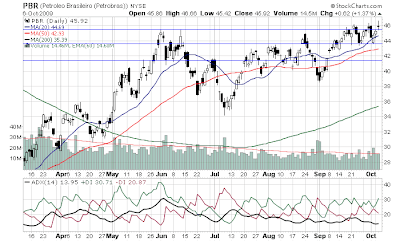

IMO, the best way to play the potential push upward is, my favorite, PBR. PBR also looks interesting, as it appear to be breaking out on the upside, and the DMI looks to be forming a pretty bullish set up.

Tomorrow there is the weekly Oil report, and that could change the fundamental view yet again. But, overall, things generally look bullish right now for oil.

No comments:

Post a Comment